John M Lund Photography Inc/DigitalVision via Getty Images

What is driving the stock market these days?

Uncertainty.!

I have been writing more and more about the uncertainty that exists within the stock market, the financial system, the economy, and the world.

Just since the first of the year, uncertainty has been rising.

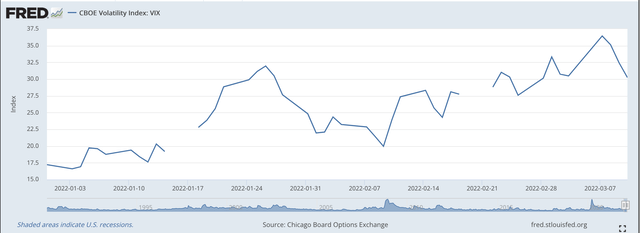

Take a look at the VIX volatility index.

Stock market volatility (Federal Reserve)

On December 31, 2021, the VIX index was around 17.00.

This past week, the VIX index averaged just above 33.00.

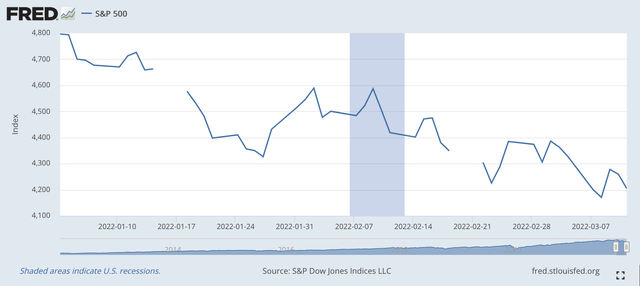

The S&P 500 Stock hit its last historical high on January 3, 2022, at 4,796.56.

It has been downhill since.

S&P 500 Stock Index (Federal Reserve)

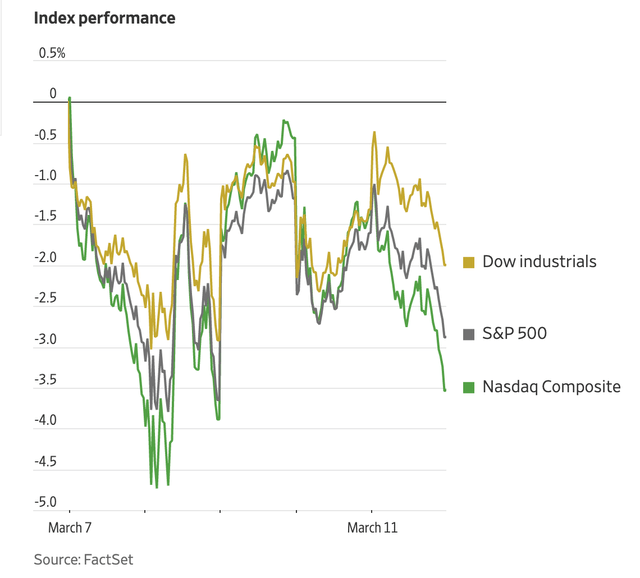

We can just look at this past week’s market behavior to judge the volatility that exists in the marketplace.

Performance of Stock Prices in past week (Wall Street Journal)

Lots and Lots of Uncertainty

I have been writing about the uncertainty that exists these days and has labeled the time period we are going through a period of radical uncertainty,

For readers that would like to learn a little more about radical uncertainty, I would recommend they take a look at the book “Radical Uncertainty: Decision – Making Beyond the Numbers,” (W. W. Norton & Co.; 2020).”

The book is written by John Kay and Mervyn King.

Mr. Kay is an economist who teaches at Oxford University and wrote a column for the Financial Times. Mr. King is the former governor of the Bank of England and a professor at New York University.

The crucial thing about radical uncertainty is that you, the decision-maker, don’t know all the possible outcomes that might occur in a particular situation.

For example, much of the discussion around the first of January this year was about the rising rate of inflation in the U.S. and the question about what Jerome Powell, Fed Chair, and the Federal Reserve were going to do about moving from a period of quantitative easing and to a period when the battle was launched against this rising inflation.

Was a Russian invasion of Ukraine really on the minds of investors at that time?

This Russian invasion was not even on the watch list of investors at that time.

Well, now we have new possibilities that are considered by investors as they go about planning what they should buy or sell.

But, what are we missing now?

What other event…or, events…or not included in our list of possible occurrences?

Recently, North Korea has been testing nuclear missiles. Given all the fuss that Russia has created with its invasion, maybe the North Koreans are considering some action of their own since the U.S. and most of the Western nations are focused on what is happening in eastern Europe.

Is that a possibility on your list of things that might happen? If so what probability have you given to the possibility that this event might happen?

And, what else is out there that is not yet registering on our screen?

This is radical uncertainty.

This Is The Future

Corrie Driebusch and Caitlin McCabe in Saturday’s Wall Street Journal quote Joseph Amato, chief investment officer of equities at Neuberger Berman Group LLC:

“Everyone’s on edge. The market is ready to bounce back if the Ukraine crisis de-escalates, but markets could also be more volatile and fall further if it worsens.”

In the same article Justin Wiggs, managing director in equity trading at Stifel Nicolaus, is quoted as saying:

“It’s almost like we’re in purgatory. You’re trying to invest, and there are a lot of things you can’t model.”

And, it looks as if things are going to stay this way for a while.

Jerome Powell and the Federal Reserve are ready to raise their policy rate of interest this week. And, the Fed has indicated that it would like to raise the Fed Funds rate several more times this year.

Furthermore, the Fed has talked about letting its securities portfolio runoff and reducing the size of its balance sheet.

But Mr. Powell and his team have been very cautious in the past, wanting to err on the side of monetary ease so as to avoid any financial market “accidents” and are expected to do the same as the Fed “tightens” money in the near future.

Right now, the Fed is giving off very few signals as to what it will really do over the next few months.

So, radical uncertainty will continue on into the future.

My best guess for the near future?

Continued decline in stock prices.

from WordPress https://ift.tt/nvsrgTK

via IFTTT

No comments:

Post a Comment